LOAN SERVICES

We can help with all your financial needs

Alco Federal Credit Union is here to help you with all your financial needs. Because of this, one of the many services that we offer is the “Managed Credit Program” that was started to help as many members as possible obtain credit .We realize that some members may have experienced some difficulty with their credit in the past. The rate a member pays will be determined by their credit history. Members with good or excellent credit histories will receive our very best rates, some of the best rates offered by any lender.

VISA Platinum credit cards

Choose between a rewards card or a low interest card. Get a 2.99% interest rate for the first 6 months after signing up! Move your high interest credit card balances over with no balance transfer fees. There are no annual fees or cash advance fees!

Personal signature loans

Upon approved credit, the credit union offers Personal Signature Loans to qualified members. These loans don’t require any collateral, just your promise to pay, making them a great alternative to credit cards for smaller expenses like vacations, car repairs, or holiday gift giving.

Overdraft protection loans

If you accidentally overspend using your checkbook or debit card, you don't have to worry with an Overdraft Protection Loan. This loan backs up your designated Share Draft (Checking) Account and helps you avoid any non-sufficient funds (NSF) fees.

Personal line of credit loan drafts

If you have credit card balances with high rates and full repayment that is not in the foreseeable future, then you should consider the Alco FCU Line of Credit Loan Draft. These loans are perfect for specific purposes like consolidating your credit card balances to a lower rate, repairing your car and fixing up your home with upgrades or new furniture. These loans are versatile because they can be used for just about anything you choose!

Mortgage loans

Whether you want a loan for a new home purchase or looking to reduce the interest rate on your current mortgage with a loan refinance, Alco Federal Credit Union has the right mortgage option for you!

New and used auto loans

Searching for just the right vehicle can be extremely time consuming. Don’t waste additional time searching for a place to finance your loan. Our rates are competitive, the loan application process is quick and convenient, and the service you’ll receive is friendly and efficient. We finance both new and used vehicles.

New and used mobile home, boat, and RV loans

Alco FCU wants to help you get the grown-up toy you've always wanted. Whether it's a boat, a motorcycle, or a travel trailer, Alco has an RV loan that is quick, affordable, and hassle free.

Share secured loans

Share Secured Loans are loans backed up by your own Share (Savings) Account. Naturally, these loans have a lower interest rate because payment is guaranteed by an amount in your share account that is equal to the balance of the loan. Your savings will continue to earn dividends while you are paying up the loan, making this loan perfect for first time borrowers wanting to establish their credit.

Farm equipment loans

Agriculture and ranching have additional needs that ordinary businesses don't. Alco FCU understands your needs and unique business challenges. Our Farm Equipment loans can be used for tractors, trailers, and multiple types of farm equipment.

ONLINE SERVICES

Bank on your time on desktop and mobile

Here at Alco Federal Credit Union, we strive hard to make our services availble to our members in every way possible. Our free Online Services are available 24 hours a day, seven days a week, giving you the ability to do business with us whenever it is convenient for you.

BANKING MADE EASY

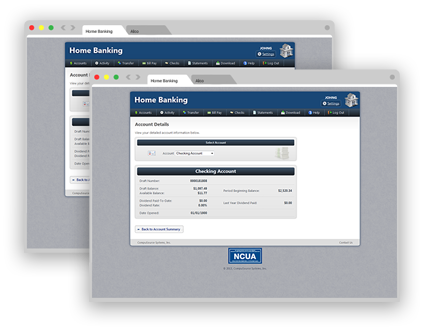

Real Time Home Banking

Discover the convenience of banking from the comfort of your home, any time, day or night! Home Banking is a FREE service offered to all Alco Federal Credit Union members. It allows you to access your Credit Union accounts 24-hours a day, 7 days a week.

Security

Multiple levels of security to ensure your money is safe!

Transfers Funds Instantly

Transfer funds to other credit union accounts or loans.

Remote Deposit Capture

Check deposits in a snap! All you need is your phone!

Branch Locations

Locate ATMs and branches nearest to you.

ONLINE BILLPAY

Pay bills the easy way

Bill Payment is a service that makes it simple and convenient to pay your monthly bills from your Alco Federal Credit Union checking account, via the Internet. Save time and money, pay bills online for FREE! Contact the Credit Union to enroll today!

Stay Safe. Stay Organized. Go Paperless.

OTHER SERVICES

We offer a number of other services to our members

Alco Federal Credit Union offers you a number of other free or discounted services to its members. These services are simply meant to help enhance your benefits as a member of the credit union.

Wire transfers

A wire transfer is a fast, convenient way for members to transfer funds from their Alco FCU account to another financial institution. There's no waiting or delays when the transfer is made, so you can be assured that the party on the other end has immediate access to the wired funds.

Outgoing wires

The receiving institution must be contacted for specific wiring instructions before the wire transfer can be completed. The account holder assumes sole responsibility for providing correct wiring instructions.

When requesting an outgoing wire transfer, please have the following information available:

- Your name, Alco Fcu account number and the amount of the wire transfer.

- Institution and branch name

- Exact address of the branch (including street, city, zip and country)

- Institution Branch Routing and Transit Number

- Name of the person or company to whom you are sending the wire, their address and account number

- Further credit information (final beneficiary), if necessary

- Foreign Swift Code for international wires, if available

Incoming wires

Funds must first be wired:

- Alloya Corporate Federal Credit Union

- 184 Shuman Boulevard Suite 400

- Naperville, IL 60563

- Routing & Transit # 221381715

Further credit to:

- Alco Federal Credit Union

- 2859 Lindy Lane

- Wellsville, NY 14895

- Routing & Transit # 222380391

Final credit to:

- Members

- Members account #

Free notary public service

Alco Federal Credit Union has employees that are able to notarize your documents. This service is free to all members of the credit union. Please bring your state- or government-issued identification such as your driver's license or passport when you come in to have your documents notarized.

Direct deposit

Convenient automatic and safe, Direct Deposit is a smart and easy way to have your paycheck, retirement check, or Social Security check deposited automatically into your account.

Payroll deduction

Payroll Deduction (if offered by your employer) is a free service that allows you to automatically deposit money into your Alco FCU account directly from your paycheck! You choose the amount and just watch your savings grow! It is an effective way to budget your hard-earned dollars.

Money orders

For those times when you can't use a personal check, money orders are an easy way to make payments. For a minimal fee, you can purchase money orders at the credit union for any amount up to $1,500.00.

NADA used car information

Alco Federal Credit Union wants to help you make the right decisions when buying a vehicle. That's why we partnered with NADA to help you find useful information and estimated values about your next new or used vehicle.

Night deposit

Our Night Deposit service allows you to deposit funds at your convenience. Available 24 hours a day, our Night Deposit is a safe and secure way to deposit your funds outside of regular hours.

Credit life and disability insurance

Do you really need coverage for your loans?

Life can take some unexpected turns. That’s why there’s Credit Insurance.

When your family experiences a hardship, the last thing they need is additional worry about how to pay your debts. Credit Disability and Credit Life Insurance could make your loan payments in the event of a covered disability or even your death.

Enjoy the security that could come with being covered. Ask about Credit Disability and Credit Life Insurance today.

Disclosure:

Credit Life and Credit Disability Insurance, underwritten by CMFG Life Insurance Company (Home Office: Waverly, IA), is optional to purchase and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions and exclusions may apply. Please contact your loan representative or refer to the Group Policy for a full explanation of the terms. Base Policy Nos. CI-MP-POL, CI-SP-POL, B3a-830-0996, B3a-800-0695, B3a-800-0288, CI-MP-CE-POL; CI-MP-OE-CC-POL; CI-MP-OE-POL; B3a-800-0992.

VT only: Claims may be filed by contacting your credit union. If you have questions regarding your claim status, contact CMFG Life at 800.621.6323. Only a licensed insurance agent may provide consultation on your insurance needs.

Copyright & Unique ID:

© TruStage

CDCL-3415605.2-0224-0326

College Scholarships

John Patterson was a retired electrical engineer, who was also active as both a beef and tree farmer. He served as treasurer of ALco Federal Credit Union for 32 years. His dedication and contributions to the credit union were insurmountable. Because of John’s unique involvement for so many years on the Board of Directors, we are honoring him by offering this scholarship in his name.

Apply for a scholarship now